Fractional Reserve Banking Refers To A System Where Banks

Olivia Luz

Reserve refers to the percentage of money held in custody which is not lent out.

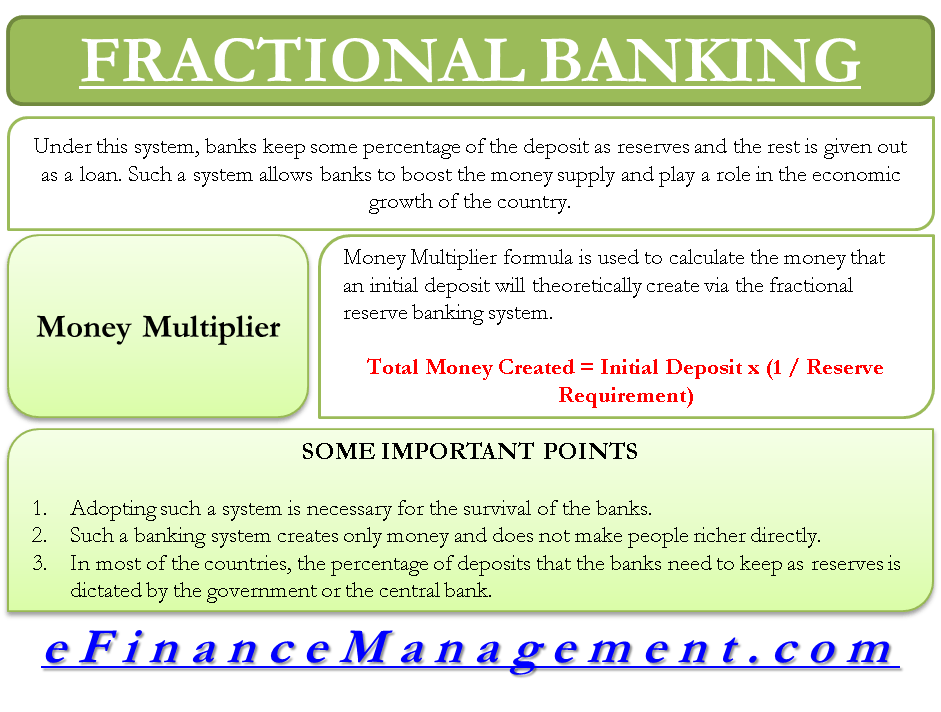

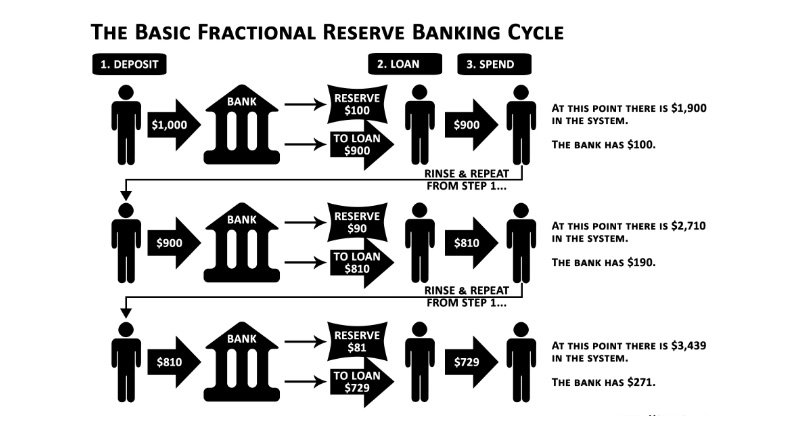

Fractional reserve banking refers to a banking system in which. The fed establishes reserve requirements regulations on the minimum amount of reserves that banks must hold against deposits. Fractional reserve banking is a system that allows banks to keep only a portion of customer deposits on hand while lending out the rest. How fractional reserve banking works.

In a fractional reserve banking system banks keep a fraction of deposits as reserves and use the rest to make loans. Fractional reserve banking refers to a system where banks. This is done to theoretically expand the economy by. B bank reserves are only a fraction of required reserves.

It is important to differentiate between two different definitions of fractional reserve banking. D bank loans are less than bank reserves. Fractional reserve banking is a system in which only a fraction of bank deposits are backed by actual cash on hand and available for withdrawal. In a fractional reserve banking system banks can create money through the lending process.

RELATED ARTICLE :

- north padre island hotels on the beach

- north face half zip fleece pullover women s

- not your mother s clean freak cleansing conditioner

Hold only a fraction of their deposits in their reserves. A bank deposits are less than bank reserves. A keep 100 of their liabilities always on reserve. The reserves of a commercial bank consist of.

B hold reserves equal to a fraction of their deposit liabilities. C bank reserves are only a fraction of total deposits. Banks may hold more than this minimum amount if they choose. Critics of the system say it creates the danger of a bank run where there is not enough money to meet withdrawal requests.

Note on fractional reserve banking. So a portion of the savers money is held in custody reserve and the rest is invested. Bank reserves are held as cash in the bank or as balances in the bank s account at a central bank.

Source : pinterest.com